In the rapidly evolving world of blockchain and digital assets, new innovations are continually reshaping how we interact with technology. One such innovation, coming from Solana’s leading NFT marketplace, Tensor, is the introduction of Price Lock.

This novel feature offers both traders, NFT holders, and creators a unique way to engage with NFTs, providing a blend of flexibility, security, and potential for high yield. Let’s embark on a comprehensive exploration of Tensor Price Lock, breaking down its components, benefits, and functionalities.

Introduction to Tensor

What are Tensor?

Tensor is leading NFT marketplace on Solana. This platform stands out for its deep liquidity across a vast array of collections, boasting coverage of over 30,000+ NFT collections. Traders and creators alike are drawn to Tensor for its lightning-fast, real-time updating UI, advanced trading functionalities, and a suite of tools designed for professional market-making and collection-wide bids. Additionally, the marketplace offers enticing rewards for trading activities, making it a hub for digital asset enthusiasts.

Benefits and Advantages of Tensor

- Deep Liquidity: Ensures seamless trading across a wide range of NFT collections.

- Real-time Updates: Keeps users informed with instant UI updates.

- Advanced Trading Tools: Caters to professional traders with sophisticated needs.

- Rewards: Incentivizes trading with fun and lucrative rewards.

What is Price Lock?

Price Lock is a groundbreaking feature introduced by Tensor, designed to revolutionize how NFTs are traded. It allows users to “lock-in” a buy or sell price for NFTs for a duration of 7 days, offering a unique approach to trading that mitigates some of the volatility inherent in the NFT market.

What makes Price Lock exciting?

Price Lock’s allure lies in its simplicity and effectiveness. It is a peer-to-peer feature that operates without protocol risk and does not depend on oracles, making it a straightforward and secure way to trade NFTs.

Features of Price Lock

- Peer-to-Peer Transactions: Ensures a direct and secure trading environment.

- No Protocol Risk: Reduces the uncertainty and risk associated with automated protocols.

- Oracle Independence: Operates without the need for external price feeds, ensuring autonomy.

Advantages and Benefits of Price Lock

- Flexibility: Offers traders the ability to lock in prices, providing a hedge against market volatility.

- Security: Minimizes risks by facilitating direct transactions between users.

Why You Should Use Price Lock

Using Price Lock can significantly enhance your trading strategy, allowing for efficient capitalization on short-term price movements and providing a mechanism for hedging against potential losses. Whether you’re looking to go long or short on an NFT, Price Lock offers a cost-effective and innovative solution.

Using Price Lock as Takers

For those looking to engage with NFTs beyond mere collection, Tensor’s Price Lock presents a unique opportunity. Takers, or users who “take” the market price by entering into transactions, can leverage Price Lock to speculate on price movements or hedge against potential losses.

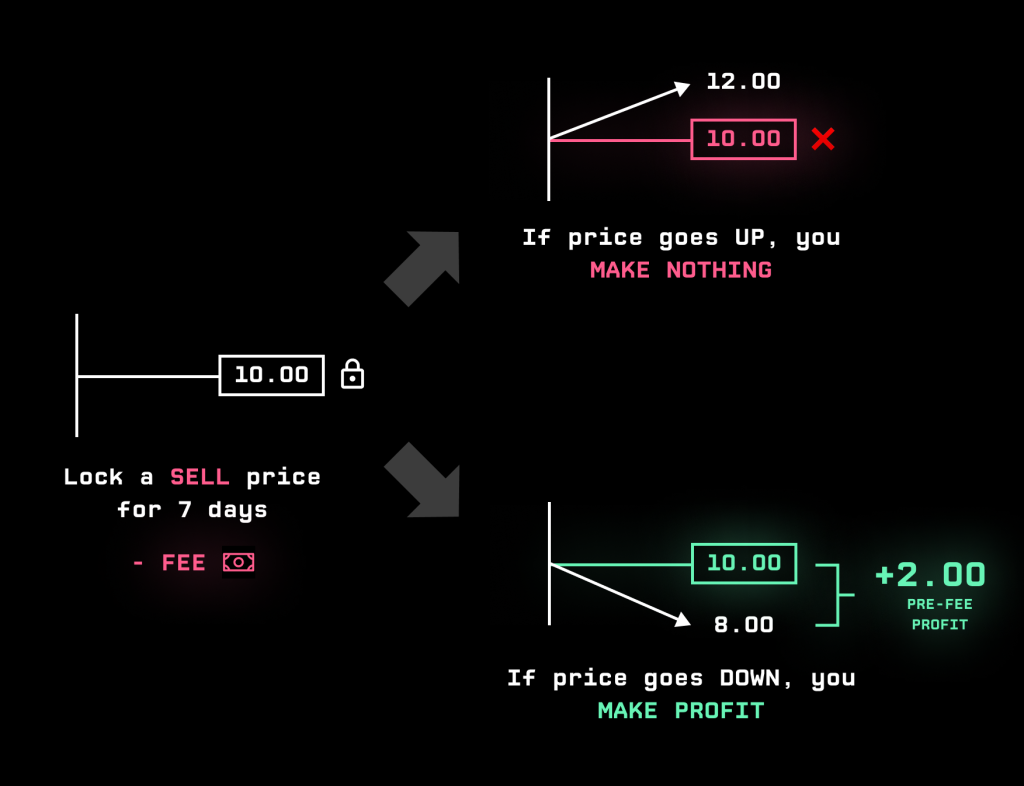

What is Locking a Sell Price (Short NFT)?

Locking a sell price, commonly referred to as going short, involves setting a future price at which you’re willing to sell an NFT. This strategy is employed when you anticipate the NFT’s value will decrease. By paying a nominal upfront fee, you secure the right to sell at this predetermined price. If the market price dips below your locked price within the 7-day window, you stand to profit from the difference.

- Example:

Imagine, you locking a sell price of 100 SOL for an NFT, with a 3.5% upfront fee. If the NFT’s market price falls to 95 SOL, exercising your lock lets you profit from the 5 SOL difference, minus the initial fee, turning a bearish market to your advantage.

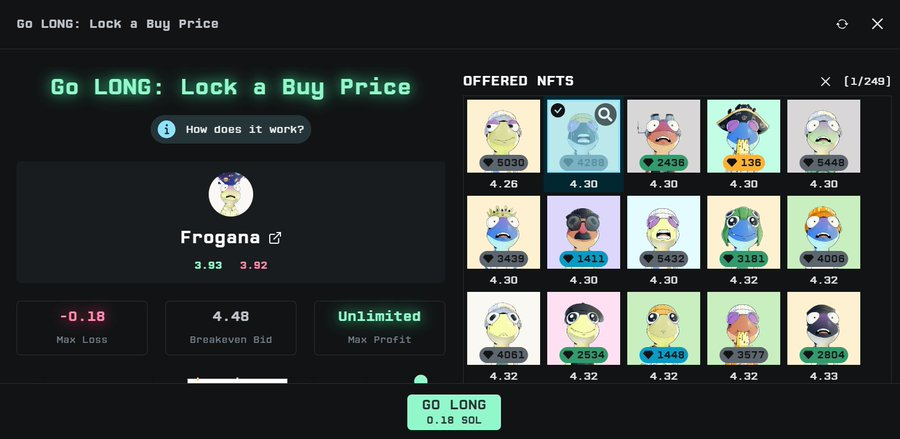

What is Locking a Buy Price (Long NFT)?

Conversely, locking a buy price, or going long, entails fixing a future purchase price for an NFT based on the expectation that its value will rise. This approach requires a small upfront investment, granting you the option to buy the NFT at the locked price before the term expires.

- Example:

Imagine, you locking in a buy price of 100 SOL for an NFT at a 3.5% fee, and the NFT’s value increases to 105 SOL, you can exercise your option to achieve a net gain, showcasing the potential for capital efficiency and profit in a bullish market.

Using Price Lock as a Maker

Makers, or those who provide liquidity to the market, find in Price Lock a versatile tool for earning yield on their assets. By funding locks, makers can earn attractive returns, contributing to the liquidity and dynamism of the NFT marketplace.

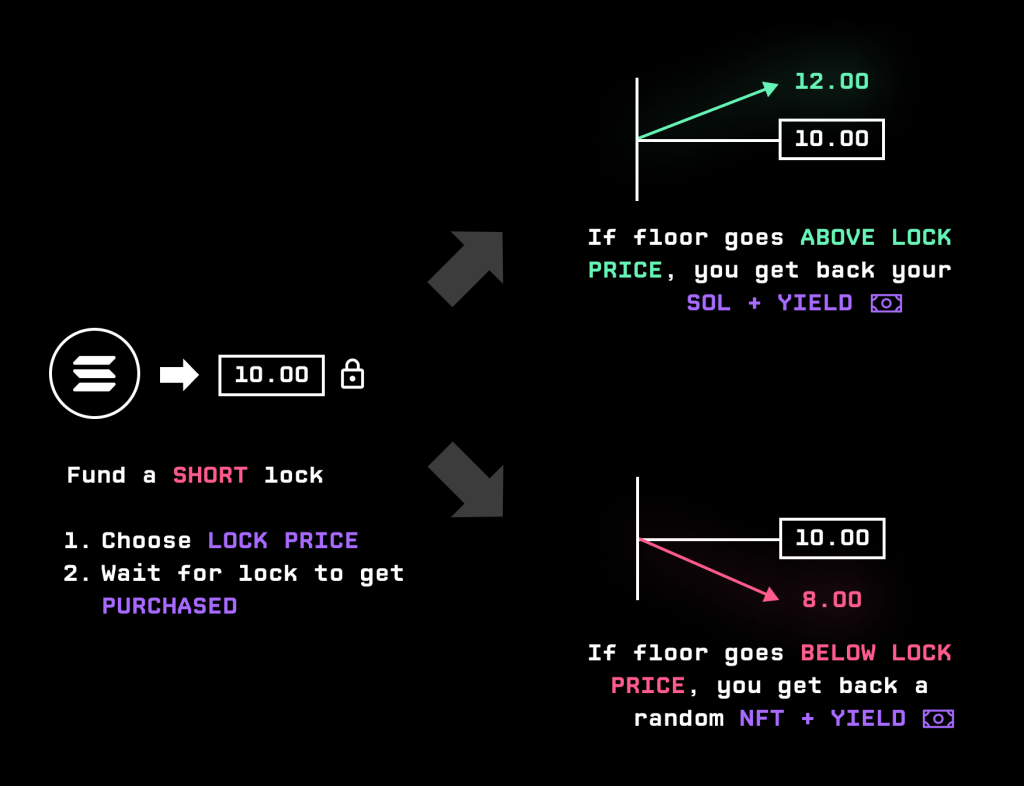

What is Fund SHORT Locks?

Funding SHORT Locks involves allocating SOL to back a sell lock, offering a way to earn yield on your capital. This method resembles NFT lending but is distinguished by its upfront interest payment, adding a layer of efficiency and yield potential.

- Example:

Imagine, you fund a SHORT lock at 100 SOL. When the NFT goes down, you will receive NFT and yield, but when the NFT goes up above your lock price, you will receive the NFT and yield.

What is Fund LONG Locks?

Funding LONG Locks, on the other hand, allows makers to offer NFTs to back buy locks, earning yield from the fees paid by takers. This strategy is ideal for NFT holders seeking to capitalize on their collections without selling outright.

- Example:

Imagine, you fund a LONG lock with an NFT worth 100 SOL. When the NFT goes up above your price, you will receive 100 SOL and yield, but when the NFT goes down bellow your price, you will receive back your NFT and yield.

Step-by-Step Guide to Using Price Lock

Begin by visiting https://www.tensor.trade/lock. This page serves as your gateway to engaging with the Price Lock feature, providing a user-friendly interface for initiating your transactions.

Step 2: Choose Your Position

Once on the site, you’ll have the option to select between going Long or Short on your chosen NFT collection. This decision should align with your market predictions and investment strategy, allowing you to capitalize on potential price movements.

Step 3: Select Your NFT

After deciding your stance, a popup will appear, prompting you to select the specific NFT you wish to lock. Clicking the “See NFT” radio button will display available NFTs for your selection, enabling you to choose the one that best fits your criteria.

Step 4: Review the Summary

Next, take a moment to review the summary section, which outlines the one-time fee required to initiate the Price Lock. This fee varies but typically ranges from 3-4% of the NFT’s value, representing the cost of securing your position.

Step 5: Confirm the Transaction

With your NFT selected and the terms reviewed, click “Go Long” or “Go Short” to proceed. You will then be asked to confirm the transaction in your wallet, finalizing your Price Lock transaction.

Congratulations! You have successfully utilized the Price Lock feature. This tool not only enables you to strategically position yourself in the NFT market but also opens up a new realm of trading possibilities within the Solana ecosystem.

Market & Metrics Analyst

Based on the Tensor by @top dashboard, Tensor has the largest daily trade volume compared to Magic Eden, Coralcube, and Hadeswap, especially in 2024.

Based on the graph, the number of trades, number of buyers, and trading volume will continue to increase throughout 2024. This shows that Tensor is a platform that is widely used by NFT lovers.

Conclusion

In conclusion, Tensor’s Price Lock introduces a novel dimension to NFT trading, offering both takers and makers an array of strategies for managing risk, leveraging market movements, and earning yield.

Whether you’re a speculative trader eyeing short-term price fluctuations or a strategic maker looking to capitalize on your assets, Price Lock stands as a testament to the innovation and flexibility within Solana’s bustling NFT ecosystem. Want to do your own research, here are useful links for you

- Website: https://www.tensorians.com

- Trade NFT: https://www.tensor.trade/

- Trade Price Lock: https://www.tensor.trade/lock/

- Twitter: https://www.twitter.com/tensor_hq