In the ever-evolving landscape of cryptocurrency and blockchain technology, Ordiswap emerges as a groundbreaking protocol that bridges the worlds of Bitcoin and DeFi (Decentralized Finance). Ordiswap introduces the first Automated Market Maker (AMM) on Bitcoin’s native layer, bringing unprecedented capabilities to the Bitcoin ecosystem. Powered by the $ORDS (ERC20) and $REOS (BRC20) tokens, Ordiswap offers interoperability, unique staking mechanisms, and a modular approach that pushes the boundaries of decentralized finance.

What is BRC-20 and Ordi?

BRC-20 and Ordi are concepts related to a proposed fungible token standard for Bitcoin. As of my last knowledge update in January 2022, I don’t have specific information about BRC-20 or Ordi because they seem to be relatively new developments in the world of cryptocurrency and blockchain. However, based on the information you provided, here’s a summary:

BRC-20 Token Standard:

- Introduction: BRC-20 is described as an experimental fungible token standard for Bitcoin, introduced by @domodata on Twitter in March 2023.

- Purpose: BRC-20 aims to demonstrate the creation of fungible tokens on the Bitcoin blockchain using ordinal theory and inscriptions.

- Key Features:

- It facilitates the creation, minting, and transacting of fungible tokens on the Bitcoin blockchain.

- Technical details can be found in the original documentation.

- It’s designed to integrate with other Bitcoin standards and layer 1 chains like Ethereum and Stacks.

- Security is maintained through Bitcoin’s layer 1 security mechanisms, preventing double spending.

- It’s designed with simplicity and accessibility in mind, allowing anyone with a Bitcoin wallet to use it.

- Unique tickers are used to reduce scams and establish a digital namespace.

- It can leverage Partially Signed Bitcoin Transactions (PSBTs) for trading and other mechanisms.

- It employs an account-based model that offers flexibility beyond layer 1 Bitcoin.

- Use Cases:

- Fun and entertainment on the Bitcoin network.

- Asset issuance, including stablecoins and utility tokens.

- Integration into decentralized applications (dApps) for various purposes.

- Tokenization of assets and rights.

- Exchange and trading on the Bitcoin network.

- Comparison to Other Standards:

- BRC-20 is described as the most widely adopted fungible standard on Bitcoin.

- It doesn’t require a dedicated wallet feature, making it accessible with a regular Bitcoin wallet and inscription tools.

- BRC-20 uses immutable inscriptions, differentiating it from mutable smart contracts on other platforms.

- Its account-based model is seen as more cost-effective compared to UTXO-based fungible token standards.

- Its simplicity and readability are highlighted as advantages.

- It relies on open and free minting without prior announcements, ensuring provable fairness.

- Exclusive tickers are used to reduce the risk of scams.

- It can potentially integrate with systems beyond Bitcoin and doesn’t rely on a singular indexing truth.

Ordiswap operates on the BRC-20 token standard, which is Bitcoin’s equivalent of Ethereum’s ERC20 standard. This standardization allows Ordiswap to seamlessly integrate with Bitcoin’s native layer, creating a trustless and secure environment for token swaps.

What is Ordiswap?

Ordiswap is a decentralized exchange (DEX) built on Bitcoin’s layer-1 blockchain. It utilizes the BRC-20 token standard to provide users with a platform for trustless and transparent token swaps. Unlike traditional DEXs, Ordiswap doesn’t rely on layer-2 solutions or external entities, making it a pioneering force in Bitcoin-based DeFi.

The Goal of Ordiswap

Ordiswap has ambitious goals, including:

- Native Layer AMM: Deploying the first AMM on Bitcoin’s native layer, revolutionizing decentralized finance.

- Interoperability: Achieving seamless integration between BRC-20 and Ethereum, fostering a cross-chain ecosystem for tokens.

- Innovative Staking: Introducing unique staking mechanisms for $ORDS holders, encouraging active participation and earning.

- Off-chain Logic: Utilizing off-chain balance states and Bitcoin nodes for efficient and scalable protocol operations.

- API Integration: Providing developers with a comprehensive API, facilitating easy interaction with Ordiswap’s features.

- Indexed Modularity: Implementing indexing and modularity for enhanced protocol flexibility and robustness.

- Stake & Earn Logic: Enabling users to stake $ORDS on Ethereum, linking it to BRC-20 wallets, and unlocking holistic benefits and revenues.

- Liquidity Pools: Offering users the ability to participate in liquidity provision for Bitcoin-native assets, fostering deep market liquidity.

Why do we need Ordiswap?

The Ordiswap protocol addresses critical gaps in Bitcoin’s development space. It introduces a groundbreaking Automated Market Maker (AMM) on its native layer, expanding Bitcoin’s use cases and enabling seamless interoperability with BRC-20 tokens on the Ethereum network. Ordiswap’s API integration, indexed modularity, and deep market liquidity provision position it as a pivotal solution, enhancing scalability, flexibility, and liquidity within Bitcoin’s ecosystem.

What is $ORDS?

$ORDS is an interoperable utility token designed for seamless operation across Bitcoin’s native layer and the Ethereum network. With a finite supply, $ORDS facilitates community-driven decisions through voting and governance, incentivizes Bitcoin-native liquidity providers, and powers swaps on Ordiswap.

ORDS Token

- Token Name: Ordiswap Token

- Token Ticker: ORDS

- Total Supply: 1,000,000

- BRC-20 Address: To be announced

- Ethereum Address: To be announced

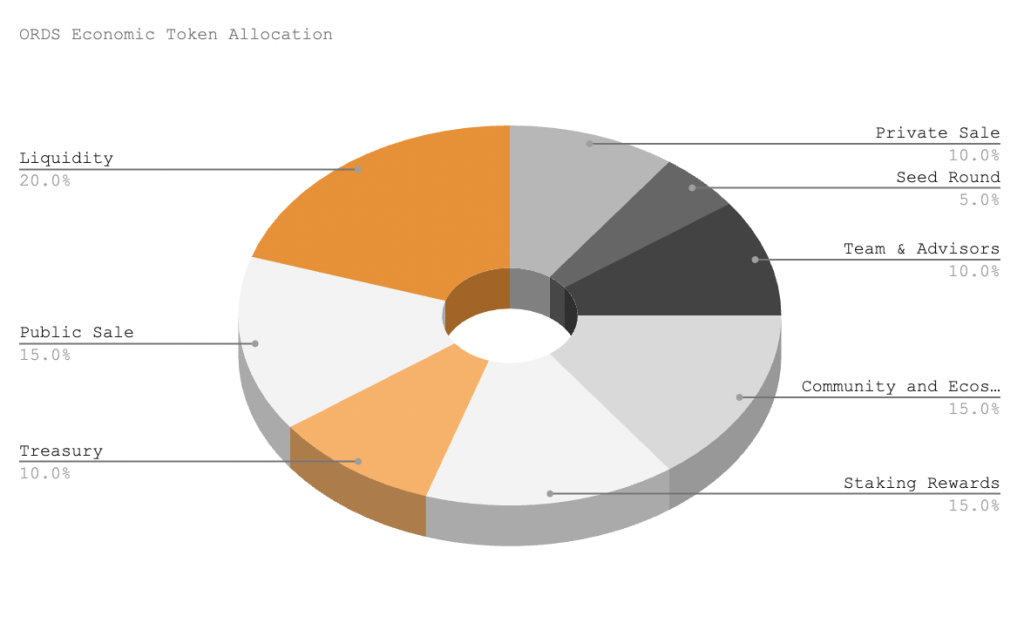

Token Allocation

Features and Usecase

ORDS, as the native token of Ordiswap, plays a crucial role in the platform’s functionality and governance. Here are some key features and use cases:

1. Governance: ORDS token holders have the power to participate in the governance of the Ordiswap platform. They can propose and vote on changes, upgrades, and new features, ensuring a community-driven ecosystem.

2. Liquidity Provision: ORDS incentivizes liquidity providers on the Ordiswap platform. By staking ORDS tokens, users can contribute to liquidity pools, earning rewards in return for their support in facilitating token swaps.

3. Utility: As an interoperable token, ORDS can be seamlessly utilized on both Bitcoin’s native layer and the Ethereum network, enhancing its utility and versatility for developers and users.

4. Platform Fees: Developers can use ORDS to pay platform fees on Ordiswap, providing a seamless and efficient way to access and utilize the DEX’s services.

5. Bridging Bitcoin and Ethereum: ORDS acts as a bridge between these two major blockchain ecosystems, enabling the flow of assets and value between them, which is a unique and valuable feature in the crypto space.

What is $REOS?

$REOS is the BRC-20 token engineered to revolutionize reward systems within the Ordiswap ecosystem on Bitcoin’s layer-1. It enables users to participate in dual-network staking, earning rewards and accruing swap fees. $REOS plays a vital role in incentivizing liquidity providers for Bitcoin-native pairs on Ordiswap’s DEX.

Ordiswap Ecosystem

Ordiswap’s Unique AMM Mechanism

Ordiswap introduces a unique approach to the Automated Market Maker (AMM) model by incorporating off-chain balance states. This innovative technique enhances efficiency and scalability, reducing the number of on-chain transactions, lowering gas fees, and speeding up transaction processing. Ordiswap leverages the Taproot upgrade of Bitcoin, enabling more complex smart contracts and improving privacy and scalability.

The Ordiswap Bridge

Ordiswap’s bridge enables cross-chain interoperability between Ethereum and Bitcoin Layer 1 networks, facilitating asset movement across these distinct blockchains. This bridge supports bidirectional asset transfer, enhances interoperability, and offers arbitrage opportunities. The fees generated from cross-chain transactions benefit $ORDS token holders, creating a self-sustaining ecosystem.

Bitcoin Standard Dollar – Ordiswap’s Native Stablecoin

Ordiswap introduces the Bitcoin Standard Dollar (BTSD), a decentralized stablecoin overcollateralized with a mix of Bitcoin (BTC) and ORDI (BRC-20). BTSD’s stability is maintained through overcollateralization, Collateralized Debt Positions (CDPs), Virtual Ordiswap Vaults, and the Ordiswap Savings Rate (OSR). $ORDS holders play a pivotal role in governing BTSD’s stability through on-chain governance.

How to use Ordiswap on Bitcoin

Ordiswap is already operational on Bitcoin, providing users with a guide on using the platform. The Unisat Wallet plays a crucial role in securely connecting to Ordiswap, initiating token swaps, and monitoring transactions. This integration with Bitcoin’s native layer ensures trustless and efficient token swaps. Below is an initial guide for a new user, using the Unisat Wallet to connect to Ordiswap and execute a token swap between ORDI and BTC.

Unisat Wallet Setup

- Download and Install Unisat Wallet: Begin by downloading and installing the Unisat Wallet from the official website or app store.

- Create or Import Wallet: After installation, create a new wallet securely or import an existing one.

Connecting to Ordiswap

- Open Unisat Wallet: Launch the Unisat Wallet and navigate to the DEX section.

- Connect to Ordiswap: Select “Connect to Ordiswap” and choose the Bitcoin network.

- Authorization: Authorize the connection using your wallet credentials.

Selecting Tokens and Pairing

- Connected to Ordiswap: Once connected, you can browse the available token pairs. For this example, choose the ORDI/BTC pair.

- Balance Check: Ordiswap will automatically check your wallet for ORDI and BTC balances.

Initiating the Swap

- Specify Swap Amount: Specify the amount of ORDI you want to swap for BTC or vice versa.

- Review Transaction Details: Review the transaction details, including gas fees and slippage tolerance.

- Confirm Swap: Confirm the swap, and the Unisat Wallet will generate a transaction.

Confirming the Transaction

- Sign Transaction: Sign the transaction using your Unisat Wallet passphrase or biometric authentication.

- Transaction Broadcast: The transaction is broadcasted to the Ordiswap protocol through your connected Bitcoin node.

Monitoring the Swap

- Track Progress: You can track the swap’s progress within the Unisat Wallet interface.

- Check Status: Additionally, you can check the status on the Ordiswap dashboard or explorer.

Completion and Post-Swap Actions

- Update Balance: Once the swap is confirmed, the Unisat Wallet updates your balance accordingly.

- Explore Features: Users can explore additional features, including liquidity provision or viewing transaction history.

Technical Overview:

- The Unisat Wallet employs BRC-20 standards to securely manage users’ private keys and interact with Ordiswap through Bitcoin nodes.

- Ordiswap’s off-chain server maintains balance states, enabling efficient AMM functionality without relying on layer-2 solutions.

- The Unisat Wallet securely communicates transaction data to Ordiswap’s back-end, initiating the swap through ordinals and BRC-20 standards.

- Ordiswap utilizes the constant product formula of Uniswap v2, ensuring fair and efficient token swaps with minimized slippage, enhancing the overall trading experience.

This guide provides a step-by-step walkthrough of how to use Ordiswap on Bitcoin, enabling users to seamlessly swap tokens while enjoying the benefits of decentralized finance (DeFi) on the Bitcoin blockchain.

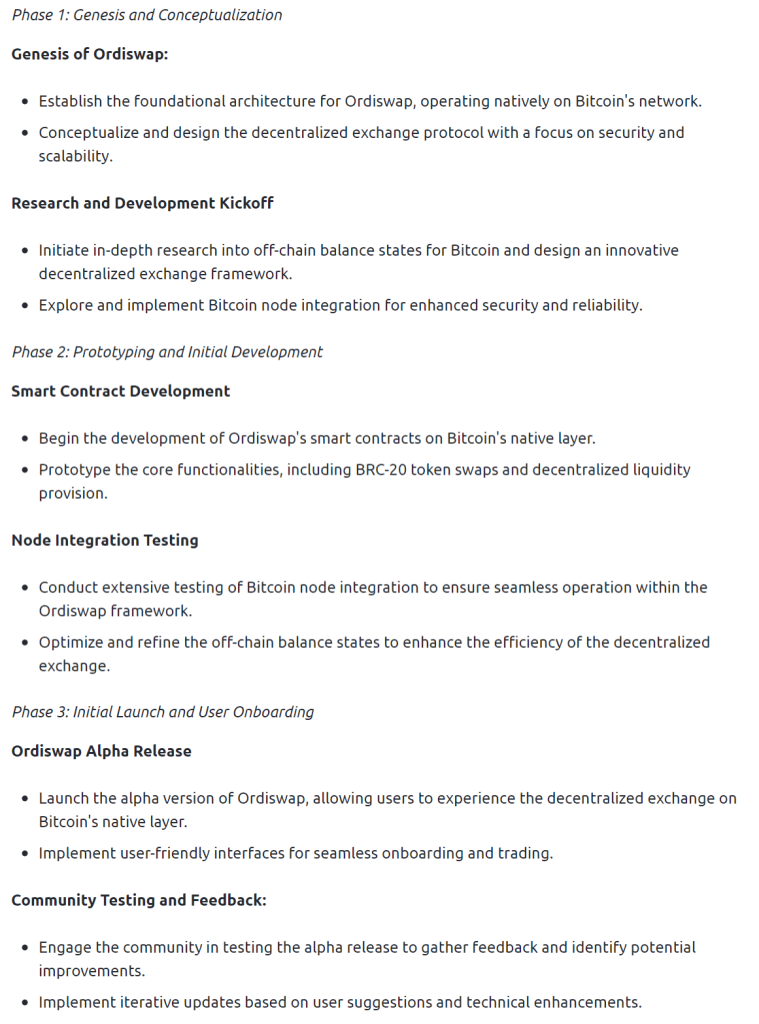

Roadmap

Ordiswap’s roadmap outlines a comprehensive plan for development and growth. Key milestones include security audits, user feedback collection, partnerships, the release of the bridge, stablecoin support, and the integration of various token standards. Ordiswap’s commitment to continuous enhancement and global expansion positions it as a trailblazer in Bitcoin-based DeFi. For detail roadmap, you can see on image bellow

In conclusion, Ordiswap represents a pioneering force in the intersection of Bitcoin and DeFi, offering innovative solutions that reshape the decentralized finance landscape. With a robust roadmap and a strong focus on user engagement and governance, Ordiswap stands poised to redefine decentralized exchanges on the Bitcoin network, opening up new possibilities in the world of cryptocurrency and blockchain technology.