In the ever-evolving world of decentralized finance (DeFi), the Cadence Protocol emerges as a revolutionary force, redefining the norms of liquidity utilization, user interaction, and transaction execution. This article delves into the intricate architecture of the Cadence Protocol, exploring its problem-solving approach, innovative features, and the myriad of benefits it offers to users in the DeFi space.

What are the Problems?

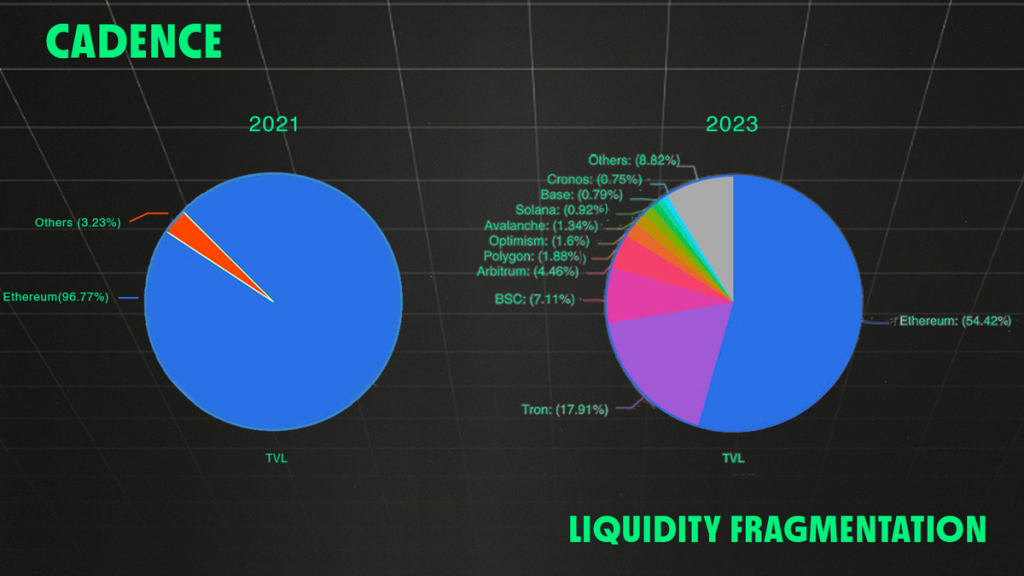

Liquidity Fragmentation

- Liquidity is spread across different blockchains and protocols, making it hard for users to access it efficiently.

- Ethereum’s market dominance has dropped to nearly 50%, with new chains constantly emerging, leading to increased fragmentation.

- Protocols and chains compete for liquidity, causing inefficiencies and forcing traders to migrate to centralized exchanges with more liquidity, but Centralized exchanges have disadvantages:

- Front-running and sandwich bots

- Centralized issue

- The lack of self-custody

- Privacy

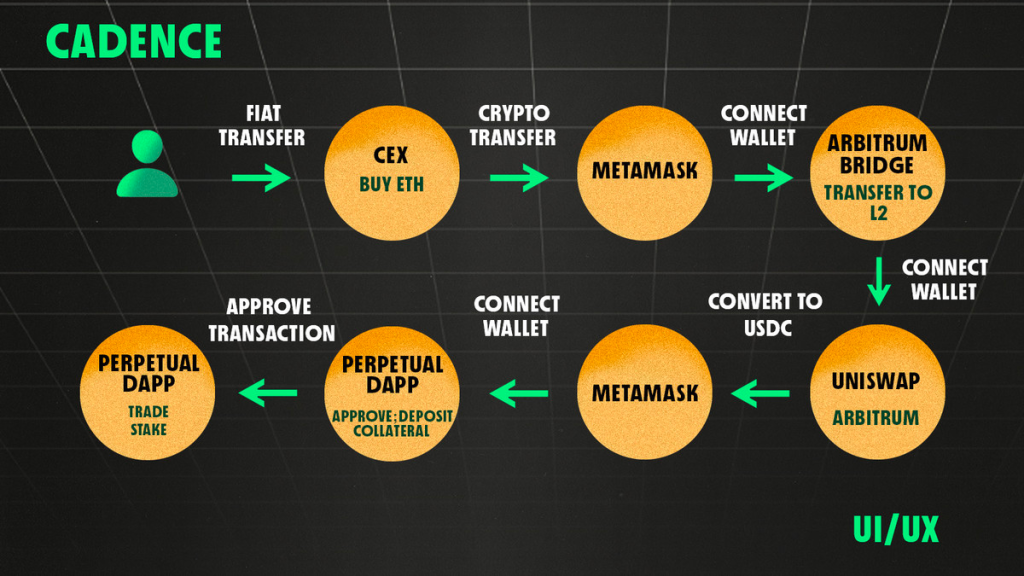

UI/UX Inefficiencies in Onchain Trading

- The process of trading on decentralized perpetual protocols is complicated and time-consuming.

- Users must find a protocol with the desired asset liquidity, locate secure bridges, wait for asset transfers, buy native tokens for gas fees, transfer tokens to their wallets, and sign multiple transactions.

- This complexity deters both novice and experienced traders from using DeFi applications.

What is Cadence Protocol?

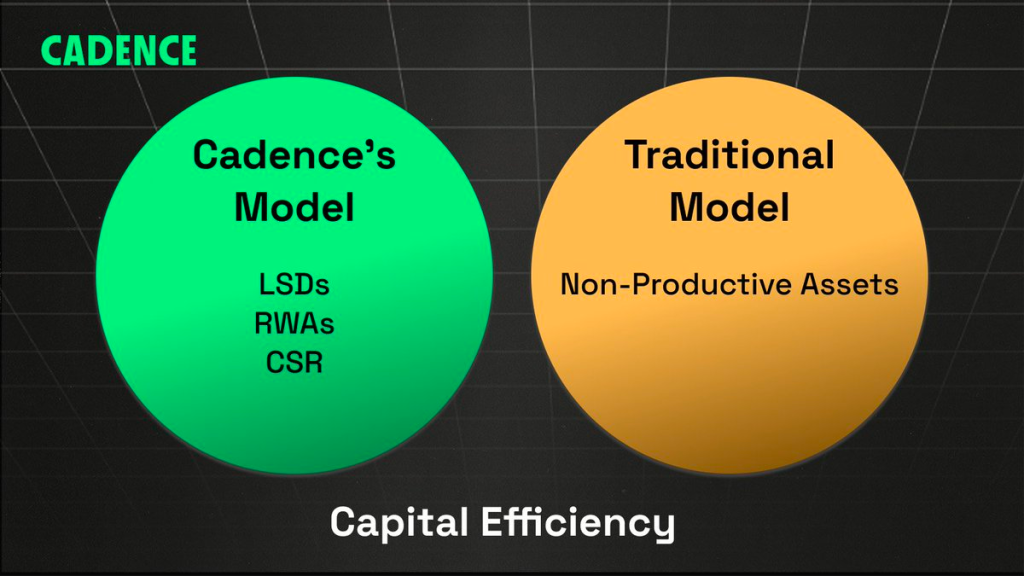

Cadence is an intent-focused perpetuals aggregator that kicks off as the leading perpetuals protocol on Canto. It’s designed to maximize the efficient utilization of liquidity by integrating Real World Assets (RWAs), Contract-Secured Revenue (CSR), and Liquid Staking Derivatives (LSDs) and improving user UI/UX with Account Abstraction.

Here are the solution presented by Cadence Protocol:

- Liquidity Unification: Cadence’s intent-based trading architecture unifies liquidity across chains and protocols, enabling simpler and lower-cost on-chain trading.

- Improved User Experience: Cadence provides Account Abstraction Smart Contract Wallets, streamlined interfaces, and one-click trading to make DeFi more accessible and eliminate the complexities of bridging, swapping, and confirming multiple transactions.

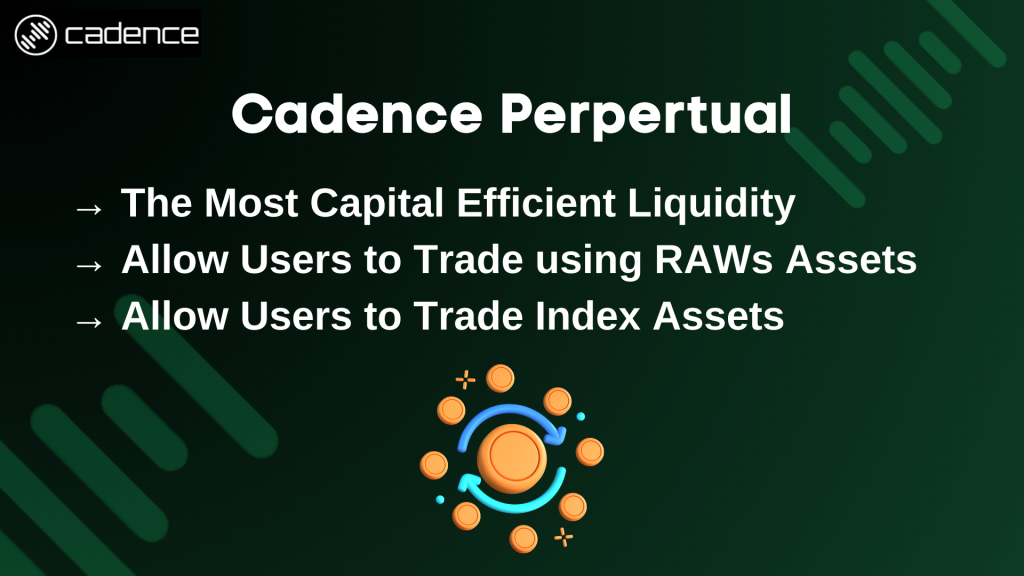

Cadence Perpetuals

Cadence Perpetuals is a forthcoming decentralized trading protocol within the Cadence ecosystem that offers unique advantages.

1. The Most Capital Efficient Liquidity

Instead of the traditional way where liquidity providers lock up their assets in a pool, Cadence has a multi-asset pool (CLP) that’s super smart. It creates mini-economies that attract more money, making it really efficient.

Cadence combines three cool features to make it efficient:

- Contract Secured Revenue (CSR): When people use Cadence, some of the fees they pay go back to users. It’s like getting a bonus while you trade.

- Liquid Staking Derivatives (LSDs): If you stake your $CAD, you get LSDs, which are like tokens that keep the same value as your staked assets. Plus, they automatically earn you rewards, and you don’t have to worry about gas fees.

- RWAs as Collateral: You can use real-world assets like $cNOTE as collateral. This makes trading safer and more interesting.

In simple words, Cadence Perpetuals is like a super-smart system that helps you trade efficiently, earn extra money from fees, and even use real-world assets as collateral. It’s designed to make the most of your capital, giving you the best possible trading experience in the world of decentralized finance.

2. Allow Users to Trade using RAWs Assets

Cadence is gearing up to introduce a groundbreaking concept called “Collateralized RWAs,” which stands for Real World Assets. These assets are something special because they exist in the real, physical world but are being tokenized and brought into the realm of decentralized finance (DeFi).

Imagine these real-world assets as things like real estate, gold, government bonds, commodities, and many other tangible or intangible things of value. They’re like the treasures of the traditional financial world, now being made available in the exciting and decentralized world of DeFi.

These real-world assets can now be used as collateral. In other words, you can use your tokenized real estate or gold as collateral for various financial activities within the DeFi space. This adds a new level of security and efficiency to DeFi.

2. Allow Users to Trade Index Assets

In Cadence Protocol, an “Index Asset” is a special type of token that represents a collection of various assets, such as cryptocurrencies or other digital assets, bundled together into one package. Think of it as a digital basket containing different types of assets. Examples of asset indexes, such as L2 indexes, Alt indexes, memecoin indexes, BTC Dominance, etc.

Why you should trade on Cadence Protocol?

Trading on Cadence Protocol offers several advantages, making it an attractive platform for traders in the decentralized finance (DeFi) space. Here’s why you should consider trading on Cadence:

1. Decentralized Keepers

Cadence has partnered with Redstone for its decentralized keepers. Keepers are automated systems that perform tasks on the blockchain without human intervention. They are crucial for managing DeFi protocols by executing transactions based on predefined conditions. Cadence’s decentralized keepers ensure that these tasks are executed efficiently and fairly, without centralized control. This reduces the risk of market manipulation and enhances the trustworthiness of the platform.

2. Efficient Trading

Cadence allows you to execute substantial trades at the market price with minimal price impact. This means you can enter or exit positions without significantly affecting the asset’s price. In times of high volatility, a small spread may exist between the Redstone price and the median price of reference exchanges, but this is designed to provide stability and fairness.

3. Transparent Fees

When trading on Cadence, you’ll encounter transparent fee structures. Opening or closing a position incurs a 0.1% fee of the position size. Collateral for long positions is held in the token being traded, while stablecoins like NOTE serve as collateral for short positions. Any necessary swaps during the process are subject to standard swap fees, which depend on whether the swap enhances or reduces the balance. Additionally, there’s an execution fee to cover blockchain network costs, ensuring a fair and efficient trading experience.

4. User-Friendly

Cadence is designed to be user-friendly, making it accessible to both experienced and novice traders. The platform provides clear information on fees, rewards, and trading processes to ensure a seamless trading experience.

Cadence Symphony

Cadence Symphony, the infrastructure powering Cadence Protocol, is designed to provide advanced features that enhance the DeFi experience for users. It comprises three key components:

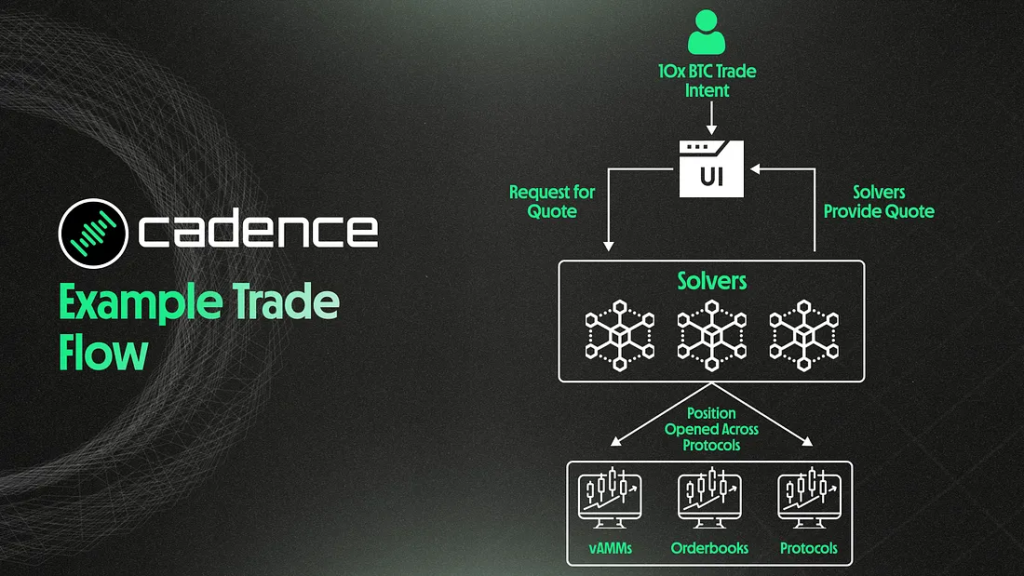

1. Intent-Centric RFQ Architecture

Intents are a fundamental concept in Cadence’s architecture. They are essentially signed sets of declarative constraints created by users to express their desired outcomes for a transaction. This is a shift from the typical way users interact with blockchain networks, where they must specify every step of a transaction.

In this intent-based architecture, specialized third parties known as Solvers or Executors review these intents in an Intent Pool. They then compete to return optimized execution paths based on these intents. This optimization can involve interactions across different networks and protocols, offering users the best possible outcomes.

The benefits of this approach are numerous. It unifies liquidity by allowing Solvers to access efficient transaction execution wherever it’s available. It enhances efficiency as Solvers compete to provide the most optimal solutions, creating a natural marketplace for efficient executions. Plus, it fosters competition among Solvers, ensuring continuous improvement and the integration of new liquidity sources.

2. Account Abstraction

Account Abstraction, facilitated by ERC-4377, empowers users with greater control and customization over their smart contract-based wallets. Users can create “User Operations” that contain transaction details to be executed on behalf of their smart contract accounts. This level of customizability and automation simplifies complex transaction flows and improves the user experience.

Account Abstraction abstracts away the complexity of transactions, allowing users to bundle multi-step transactions into a single one, pay gas fees in non-native tokens, and even set transaction limits or time-delays on their assets. It enhances security by enabling features like social logins secured by MPC (Multi-Party Computation) and social recovery settings.

The advantages of Account Abstraction in Cadence Protocol:

- Customizability: Users can automate complex transaction flows according to their needs.

- Enhanced User Experience: Abstracting away technical complexities makes the platform usage simpler and more convenient.

- Improved Security: Utilizing security features like social authentication and transaction restrictions enhances account control and protection.

- Uncompromised Control with Security: Users can grant specific permissions to Solvers over their accounts without revealing their private keys.

3. Optimized Solver Network

Cadence’s optimized Solver Network is designed to foster competition among Solvers. Solvers play a crucial role in executing optimized solutions for user intents. They earn fees in the native token based on the positions they create for users. To become Solvers, they must stake tokens, ensuring they have skin in the game and preventing spam requests.

To further incentivize proper behavior, Solvers can have their staked tokens slashed if they act maliciously, such as providing poorly optimized solutions or attempting DoS attacks. This ensures Solvers act in the best interests of users.

Cadence Token: CAD Token, esCAD, CLP

CAD Token

$CAD is the utility and governance token of the Cadence Protocol. The token is designed to offer maximum value to $CAD holders and serves as the primary utility and value capture mechanism for the project.

Utilities of $CAD Token

- 100% of fee revenue redistributed to CAD and CLP stakers

- Governance Voting Rights

- Long-term increasing share of protocol through the exit fee mechanism

- Traders must stake $CAD to enjoy increased incentives and rewards.

- Referral Program Rewards

- Solvers in Symphony must stake $CAD to participate in the ecosystem.

- Gas Payment Token via Account Abstraction

esCAD Staking

Users have the option to stake their $CAD tokens to earn esCAD, a synthetic token that represents the staked $CAD. esCAD can be utilized in various ways, including as collateral, liquidity, or for governance within Cadence Protocol and other platforms integrated with it.

Overall, $CAD and esCAD play crucial roles in the Cadence ecosystem, providing holders with a wide range of utilities and benefits, from fee sharing and governance participation to long-term protocol incentives and beyond.

CLP

CLP constitutes a leveraged trading index encompassing various assets. It functions as a liquidity receipt token within the Cadence ecosystem. CLP holders accrue Escrowed CAD rewards and 70% of platform fees in CANTO.

CLP holders play a strategic role in providing liquidity to the Cadence ecosystem, especially for leverage trading. By doing so, they enable traders to access the assets they need, contributing to the overall health and functionality of the platform.

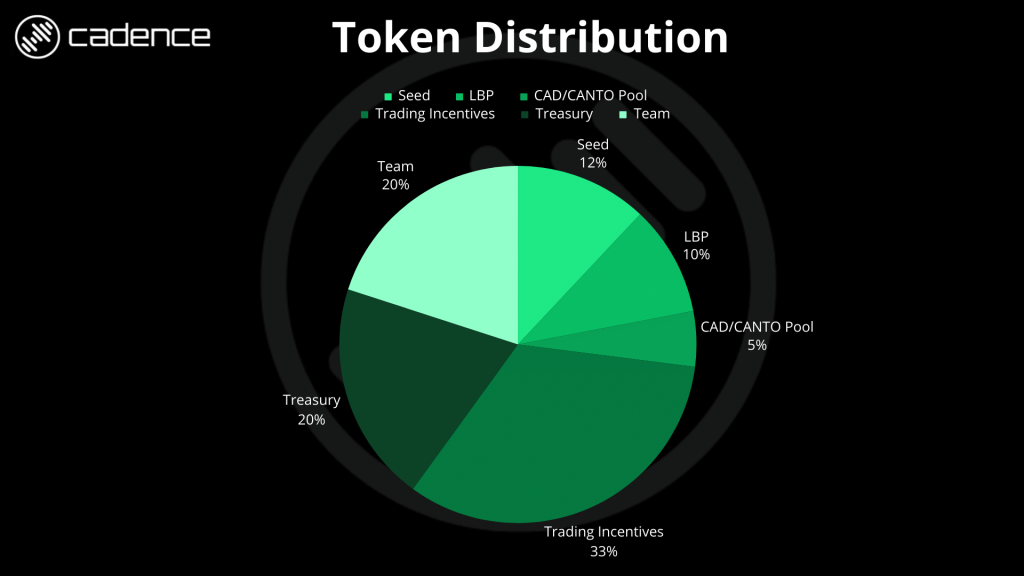

Cadence TGE Event

Cadence Protocol is conducting a Token Generation Event (TGE). This event allows the community to participate in the token sale and drive liquidity for the Cadence Mainnet. To ensure a fair and transparent token distribution, Cadence will utilize a Liquidity Bootstrapping Pool (LBP) for the Token Generation Event (TGE). This mechanism allows for price discovery in a manner that doesn’t favor sniping bots, whales, or insiders, providing an equal opportunity for all participants.

How to Prepare for the TGE

To participate in the Cadence LBP, follow these steps:

- Prepare USDC

- Prepare ETH for gas fees

The event is scheduled for January 22nd at 20:00 UTC. Visit link bellow to join Cadence LBP

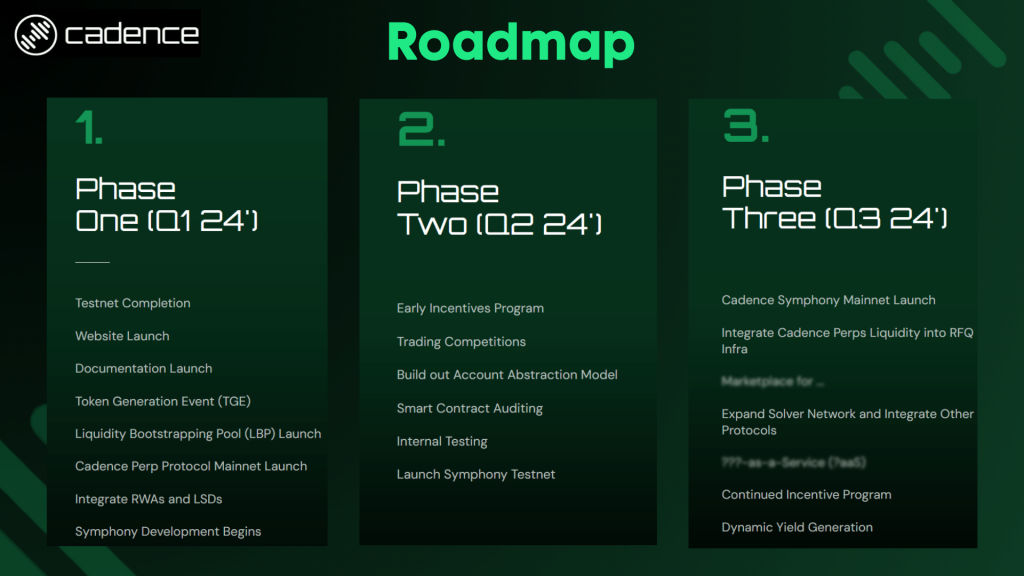

Roadmap

Cadence Protocol has a long and ongoing roadmap that is bullish for the project and protocol. You can read their roadmap pictured below

Clonclusion and Personal Thought

Cadence Protocol stands as an intriguing addition to the evolving landscape of decentralized finance (DeFi). It addresses critical issues like liquidity fragmentation and user experience inefficiencies that have plagued the DeFi space. By integrating Real World Assets (RWAs), Contract-Secured Revenue (CSR), and Liquid Staking Derivatives (LSDs) into its ecosystem, Cadence Protocol aims to offer a more streamlined and efficient trading experience while also introducing novel concepts like collateralized RWAs and trading index assets.

However, like any project, its success will ultimately be determined by its execution, adoption, and community support. If you are interested in this project, you can join LBP token $CAD today.

- Website: https://www.cadenceprotocol.io/

- Twitter: https://twitter.com/CadenceProtocol