In the realm of technological innovation, Bittensor emerges as a pioneering force, melding the realms of Artificial Intelligence (AI) and blockchain to forge a decentralized AI network. This article delves into the intricate workings of Bittensor, a platform that marks a radical shift from traditional AI frameworks, championing a model that is not only decentralized but also democratizes the AI development process.

Through its unique structure of subnets and the utilization of TAO, Bittensor not only challenges the status quo but also opens up new avenues for AI research and application. As we explore the nuances of Bittensor’s approach, including its comparison with Bitcoin, the role of subnets, and the multifaceted uses of TAO, we uncover the reasons that make Bittensor a beacon of optimism and innovation in the rapidly evolving landscape of AI and blockchain technology.

Understanding Bittensor

What is Bittensor?

Bittensor is a blockchain-based ecosystem that enables a decentralized approach to AI. It provides a platform where developers, data scientists, and AI enthusiasts can collaborate and contribute to the AI development process. By decentralizing AI, Bittensor reduces reliance on major tech companies and democratizes access to AI technologies.

Also read: How to Install Bittensor Wallet Extension in Chrome

How Bittensor Works

The core of Bittensor’s functionality lies in its ability to distribute AI tasks across a global network. Utilizing blockchain technology, it ensures transparency, security, and integrity in these interactions. Participants in the Bittensor network contribute resources such as computational power, data, or AI models and are rewarded with TAO, the native cryptocurrency of the Bittensor network.

Bittensor vs Bitcoin

Comparing Bittensor with Bitcoin offers insights into how Bittensor diverges in its approach and application. While Bitcoin’s primary focus is on securing its network and token system, Bittensor is geared towards building value-creating markets. Bitcoin utilizes a digital commodity incentive mechanism, creating a market for compute power, whereas Bittensor aims to build multiple intertwined sub-incentive systems with practical, real-world applications.

Subnets

The Bittensor blockchain hosts multiple self-contained incentive mechanisms ‘subnets’. Subnets are playing fields through which miners and validators determine together the proper distribution of TAO for the purpose of incentivizing the creation of value, generating digital commodities, such as intelligence, or data.

Each consists of a wire protocol through which miners and validators interact and their method of interacting with Bittensor’s chain consensus engine Yuma Consensus which is designed to drive these actors into agreement about who is creating value.

The Role of Subnets in Bittensor

Subnets are specialized markets or sectors within the Bittensor ecosystem, each focusing on a specific type of digital commodity or service. They operate on Bittensor’s blockchain and are crucial for facilitating specific AI and machine learning tasks.

Characteristics of Subnets

- Decentralization: Subnets are decentralized, meaning they are not controlled by any single entity, which promotes a more collaborative and open AI development environment.

- Specialization: Each subnet caters to a particular niche, such as storage, image generation, text prompting, making the network versatile and adaptable to various AI needs.

- Security: Integrated into Bittensor’s blockchain, subnets offer enhanced security for transactions and data exchanges.

Bittensor Subnets

- Root

- Text Prompting

- Machine Translation

- Data Scraping

- Multi Modality

- Image Generation

- Unknown

- Storage

- Time Series Prediction

- Pretraining

- Map Reduce

- Text Training

- Unknown

- Dataverse

- LLM Defender

- Blockchain Insights

- Audio

- Petal

- Cortex.t

- Vision

- Unknown

- Filetao

- Unknown

- Prime-Net

- Unknown

- Bitcurrent

- Image Alchemy

- Compute

- ZK Tensor

- 3D Gen

- Lovelace

- Game of Life

- Roleplay

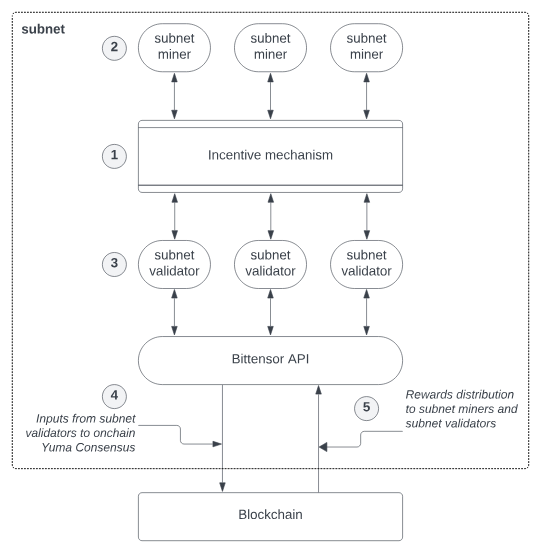

How a Subnet Works?

Subnet Components and Operations

- Incentive Mechanism: Each subnet within Bittensor is defined by its unique incentive mechanism. This mechanism dictates the tasks and goals specific to the subnet.

- Subnet Miners: Within the subnet, entities known as subnet miners are responsible for performing specific tasks. These tasks align with the objectives set by the subnet’s incentive mechanism.

- Subnet Validators: Other entities, referred to as subnet validators, operate within the same subnet. Their role is to independently assess the work done by the subnet miners.

- Validation and Consensus: Following their assessment, subnet validators express their opinions on the quality of the miners’ work. These collective opinions are then integrated into the Yuma Consensus mechanism on the blockchain through the Bittensor API.

- Reward Distribution: The outcome of the Yuma Consensus mechanism determines how rewards are allocated among subnet miners and validators. These rewards are typically dispensed in the form of TAO.

Participant Interaction in the Ecosystem

Participants in the Bittensor ecosystem, whether they are creating their own subnets or joining existing ones as miners or validators, predominantly interact within their chosen subnets. However, there remains the possibility for cross-subnet interactions, fostering a dynamic and interconnected network environment. If you are interested in creating subnets, you can read the Bittensor docs here https://docs.bittensor.com/subnets/checklist-for-subnet

TAO: The Driving Force Behind Bittensor

Understanding TAO

TAO are the lifeblood of the Bittensor network. They serve as a means of transaction and are used to reward participants for their contributions to the network. The tokenomics of TAO ensure a fair and incentivized participation, driving the growth and sustainability of the network.

In subnets, TAO play a crucial role in facilitating transactions and incentivizing contributions. Whether it’s providing computational resources, contributing data, or developing AI models, participants are rewarded with TAO, aligning individual interests with the network’s growth.

Utilities of TAO

1. Transaction Fees

TAO is used to pay transaction fees on the Bittensor Network. These transactions include when you stake, send TAO, and when interacting with the Bittensor Network.

2. Incentivization

One of the key uses of TAO is to incentivize network participants. Miners, validators, and contributors are rewarded with TAO for their efforts in maintaining and enhancing the network, such as providing computational power or contributing to AI model development.

3. Governance

TAO also plays a role in the governance of the Bittensor network. Holders of TAO can participate in decision-making processes, influencing the direction and development of the network.

4. Staking and Security

Staking mechanisms are often integral to a cryptocurrency’s tokenomics. In the case of TAO, staking may be utilized to ensure network security and stability, while also providing stakers with rewards.

Tokenomics

Supply Data

- Circulating Supply: 5,939,431𝞃

- Total Supply: 21,000,000𝞃

TAO’s tokenomics revolves around a unique combination of staking, halving events, and circulating dynamics.

- Staking: TAO holders actively participate in the network by staking TAO, contributing to security and earning rewards.

- Halving Events: TAO undergoes scheduled halving events approximately every 4 years, affecting TAO issuance rates.

- Circulating Dynamics: Most TAO are either staked or delegated, emphasizing community engagement. A significant portion remains unissued, creating scarcity and long-term value anticipation.

Reasons to be Bullish with Bittensor

1. Innovation in AI and Blockchain

Bittensor’s integration of AI and blockchain technology is groundbreaking. As TAO is at the center of this innovation, its potential for growth and adoption is significant.

2. Growing Ecosystem

The expanding Bittensor ecosystem, with increasing adoption and development, bodes well for the future of TAO. As more users and developers join the network, the demand for TAO is likely to increase.

3. Decentralized AI Market Potential

The potential of a decentralized AI market is enormous. TAO, being the primary currency of this market, stands to benefit significantly from its growth and success.

Conclusion

In conclusion, Bittensor, with its innovative approach to decentralizing AI and it’s unique subnet structure, represents a significant advancement in the AI field. By enabling a collaborative, secure, and incentivized ecosystem, Bittensor is paving the way for a more accessible and democratized future in AI development.

TAO diverse utilities, well-thought-out tokenomics, and the revolutionary potential of Bittensor’s decentralized AI network provide a strong basis for optimism about its future. As the world increasingly recognizes the value of decentralized AI solutions, TAO is well-positioned to play a significant role in this emerging market.